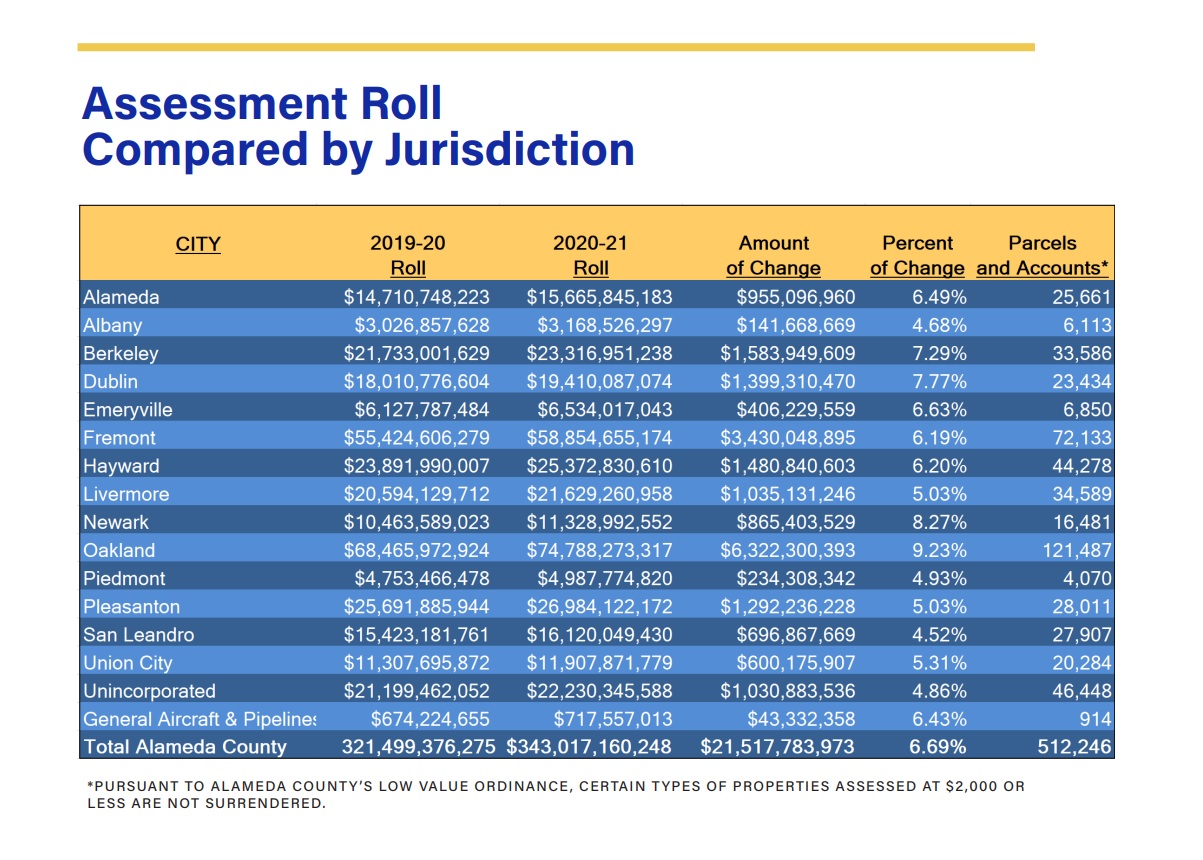

alameda county property tax 2021

Yearly median tax in Alameda County The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. The valuation factors calculated by the State Board of.

Property Taxes In The Shadow Of Covid 19 Invoke Tax Partners

Ad See Anyones Public Records All States.

. Many vessel owners will see an increase in their 2022 property tax valuations. The e-Forms Site provides specific and limited support to the filing of California property tax information. This is a California Counties and BOE website.

Alameda County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited Alameda Countys process for apportioning and. The valuation factors calculated by the State Board of Equalization and. BOE-266 - REV13 5-20 for 2021 CLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION.

Replace Proposition 58 and Proposition 193 by limiting parent-and-child. Tax Rate Areas Alameda County 2022. Ad Dont Make an Expensive Mistake.

Dear Alameda County Residents. Essentially the new law will create changes to two existing statewide property tax saving programs. Use this account to pay for your property tax payments when due.

Dear Alameda County Residents. Uncover Available Property Tax Data By Searching Any Address. Many vessel owners will see an increase in their 2022 property tax valuations.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the. Alameda County Administration Building 1221 Oak Street Room 131 Oakland California 94612. Ad Online access to property records of all states in the US.

Search Secured Supplemental Property Taxes Search Secured Supplemental and Prior Year Delinquent Property Taxes Secured tax bills are payable online from 1112022 to 6302023. Claim for transfer of base year value to replacement. Dear Alameda County Residents.

Many vessel owners will see an increase in their 2022 property tax valuations. We Make Finding In-Depth Records For Alameda Easy. A convenience fee of 25 will be charged for a credit card.

Find Alameda Property Records. Claim for reassessment exclusion fortransfer between parent and child. There should be no cost to.

Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Tax Collection Deferred Compensation Contact Us The Treasurer-Tax Collector. The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years. Offering the property at public auction achieves.

Ad Dont Make an Expensive Mistake. The valuation factors calculated by the State Board of Equalization and. Only property tax related forms are.

Dear Alameda County Residents. Pay Your Property Taxes Online You can pay online by credit card or by electronic check from your checking or savings account. For alameda county boe-19-b.

Alameda County collects on. Discover public property records and information on land house and tax online. Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Home Treasury Tax Collection Deferred Compensation Contact Us Pay Your Property Tax Pay your.

Type Any Name Search Now. Many vessel owners will see an increase in their 2022 property tax valuations. 1221 Oak St Rm 145.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. The Alameda County Fair is thrilled to welcome guests back for their rescheduled 2021 Alameda County Fair this fall October 22 through October 31. Find Alameda Property Records.

The valuation factors calculated by the State Board of Equalization and. We Make Finding In-Depth Records For Alameda Easy. 2025 M Street NW Suite 500.

County To Oakland Not So Fast On A S Waterfront Ballpark Tax Plan East Bay Times

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Business Property Tax In California What You Need To Know

Alameda County Policy Protection Map Greenbelt Alliance

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Tax Analysis Division Auditor Controller Alameda County

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Prop 19 Property Tax And Transfer Rules To Change In 2021

Proposition 19 Alameda County Assessor

Prop 19 Explained Are You Losing Winning Or Just Plain Confused

Property Tax Calculator Smartasset

Property Taxes In The Shadow Of Covid 19 Invoke Tax Partners

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Property Tax California H R Block

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Taxpayers Association Inc

Funding Seamless Transit Part 2 Who Pays What For Transit In The Bay Area Seamless Bay Area

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates